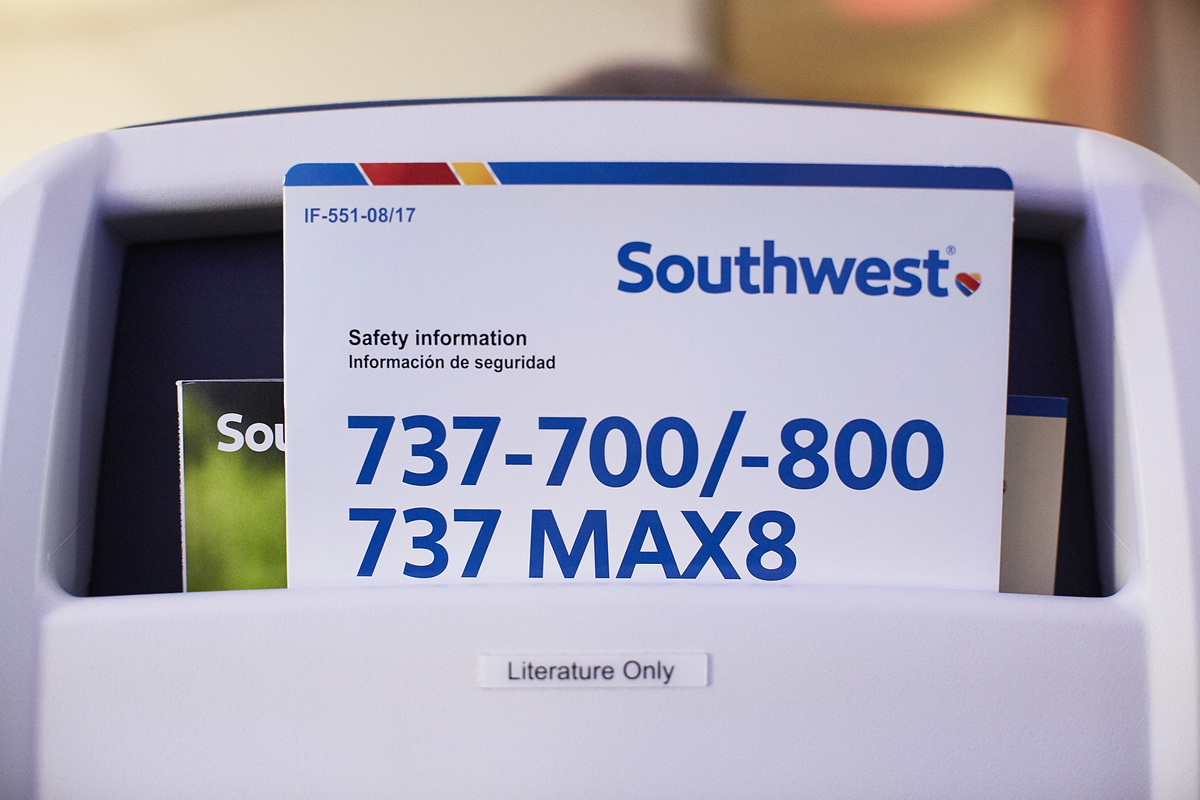

Southwest Airlines’ longtime policy of only operating one aircraft type – specifically, the Boeing 737 – has come under a lot of scrutiny over the last seven months. The airline had bet large on Boeing’s latest iteration of the 737 – the MAX series – to power its expansion plans, while also bringing down fuel costs and improving yields.

But with the 737MAX grounded since March, those plans have been scuppered. The latest estimates suggest Southwest will take a hit to its 2019 profits of at least $435 million – but the costs could easily rise as the 737MAX’s reentry into service get progressively pushed back.

In its latest update, Boeing now hopes to receive regulatory approval by the end of the year. Even if that is the case, Southwest says there will be a delay of at least one to two months between the 737MAX being cleared to fly again and the airline actually being in a position to put its fleet of 57 Boeing 737MAX 7’s and 8’s back into service.

Then there’s the question of how passengers will react to the 737MAX once it’s recertified. Some airlines are hoping to woo customers will ‘exhibition flights’, while others like United are promising to rebook nervous passengers who’d rather not chance it on an aircraft type that crashed twice in the space of less than six months resulting in the deaths of 346 passengers and crew.

Considering the size of Southwest’s 737MAX fleet, the impact on the Texan budget carrier could continue for months or even years after the plane eventually starts flying again.

Which is why Southwest has been considering whether it should still only operate just one aircraft type. In a new memo to staffers, Southwest’s vice president of Flight Operations, Alan Kasher says the airline has faced the same question in the past – going all the way back to the beginning when the founder of Southwest, Rollin King suggested the DC-9.

Unfortunately, King couldn’t get the DC-9 in the configuration or on the timeline he wanted so Southwest stuck with the 737 and hasn’t really looked back since.

But Kasher says in the memo that to “remain a serious player” Southwest must once again evaluate whether it should diversify its fleet type – whether that be with a different type of Boeing-made plane (say going widebody with the 787 Dreamliner) or even to opt for an aircraft from Airbus’s A320 range of single-aisle aircraft.

Not that doing so would be without some risks. “… increased costs, reduced efficiency in our crew network, recovery challenges in the network due to fleet complexity, and the process of changing our training,” are just some of the immediate problems that Kasher foresees with diversifying the Southwest fleet.

But then there’s the possibility of “fuel efficiencies, better bargaining power with manufacturers, and more flexibility to cover more dots on the map we don’t currently serve,” he observes.

And if Southwest does decide to pit Boeing’s 737 against another aircraft type, don’t expect to see it in the airline’s fleet anytime soon.

“If the decision was made today to add a different jet to our fleet, it would be years before we could introduce it into revenue service,” Kasher notes. “Much of our business would have to adapt and change to accommodate something different, especially considering that everything we’ve built – from our manuals, software, maintenance programs, airport facilities, etc. to the additional training required for all our operating workgroups – has been built with only the 737 in mind.”

Even when another sole 737 operator – Alaska Airlines – merged with Virgin America and took on its Airbus A320 fleet, it was at least starting with staff that knew the plane and systems in place that could manage the aircraft type.

Kasher ends by asking his staff to “be prepared for the time when we are asked to do something different…”. Could that mean flying a different model of aircraft?

TOTH: Jon Ostrower (Twitter: @jonostrower)

Mateusz Maszczynski honed his skills as an international flight attendant at the most prominent airline in the Middle East and has been flying ever since... most recently for a well known European airline. Matt is passionate about the aviation industry and has become an expert in passenger experience and human-centric stories. Always keeping an ear close to the ground, Matt's industry insights, analysis and news coverage is frequently relied upon by some of the biggest names in journalism.