Yesterday, we learned that Lufthansa planned to radically shake up its low-cost Eurowings subsidiary in an attempt to stem big losses at the carrier. Rather than pushing ahead with expansion into the long-haul market, the airline has actually taken the drastic decision to completely abandon long-haul operations, knock a planned integration with Brussels Airlines on the head and focus solely on point-to-point short-haul operations using only Airbus A320-family aircraft.

The general consensus is that the decision is an admission of failure by the Lufthansa Group and that low-cost long-haul has fallen out of favour. Some of that thinking might be true but actually, this change in strategy really shows how airlines have successfully managed to change our perception of long-haul travel.

Lufthansa has consistently said that it’s not struggling to make money on its long-haul flights. It has three really strong network brands and four hubs in Germany, Austria and Switzerland. Unfortunately, the same can’t be said of its short-haul operation.

It’s competition in the short-haul market that is dragging down the group’s profits. Overcapacity and artificially low airfares are making it a real struggle to make any money. Eurowings was meant to have a lower cost base to make the short-haul operation a success.

Instead, Eurowings has become bloated as it turned its attention to long-haul operations. The carrier had too many types of aircraft and was spreading its staff across several air operators certificates. For Lufthansa to make short-haul a success, it needs a streamlined and efficient operation.

When you put it into context, it makes complete sense that Lufthansa would take this approach with the Eurowings brand.

But that’s not to say that Lufthansa is completely giving up on low-cost long-haul. In the past, airlines believed that you couldn’t introduce low-cost elements into your core airline business for fear of ‘diluting’ the brand. Those times are long gone and yesterday Lufthansa made it clear that change would be coming to the network brands.

We’ve already heard about plans by Lufthansa to upsell Business Class passengers to “better” seats when it introduces a brand new Business Class seat on its Boeing 777X. Expect a lot more of that to come in the near future.

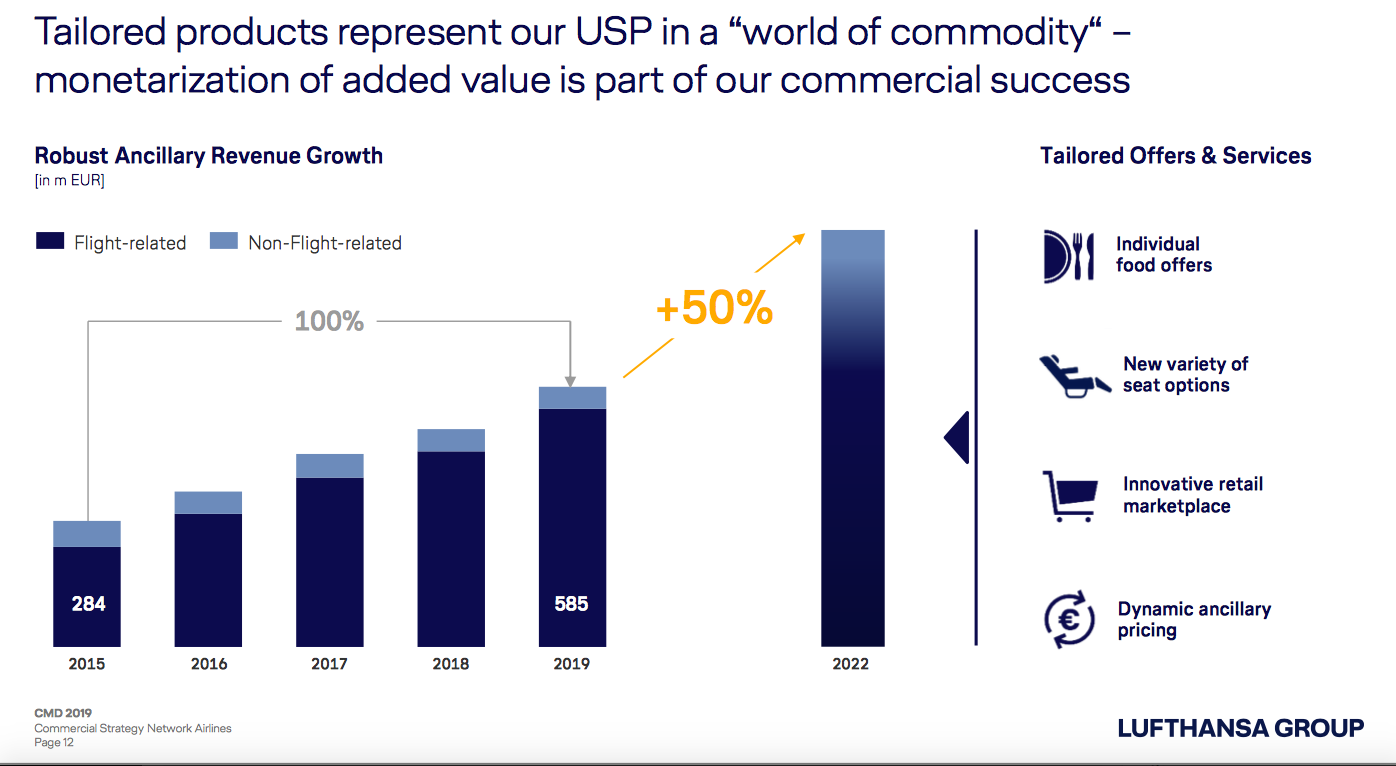

Lufthansa says it wants to proactively upsell lots more products to passengers going forward – the airline was careful not to call this ‘unbundling’ but in reality, this will probably be what it looks like. The airline points to a wealth of data it’s collected from passengers to justify these changes.

There is no one size fits all airfare any more – now there are opportunities to sell different products to different passengers at every point in the journey. This isn’t necessarily a bad thing although you can see why Lufthansa now doesn’t need a separate airline brand that does this.

What will be really interesting is how these changes affect other low-cost long-haul airlines like LEVEL or Norwegian. Could they introduce a proper Business Class cabin in the future? Or could they bite the dust as traditional full-service airlines go after the same market share?

Eurowings going long-haul probably seemed like a good idea but times have changed. I wouldn’t even be surprised to see IAG significantly change the LEVEL brand at some point in the near future.

Related

Mateusz Maszczynski honed his skills as an international flight attendant at the most prominent airline in the Middle East and has been flying ever since... most recently for a well known European airline. Matt is passionate about the aviation industry and has become an expert in passenger experience and human-centric stories. Always keeping an ear close to the ground, Matt's industry insights, analysis and news coverage is frequently relied upon by some of the biggest names in journalism.