Over the last few months and weeks, the prospect of India’s second-largest airline Jet Airways failing had become increasingly a complete certainly and definitely a case of when and not if. And yet, in announcing that it would be forced to ground all flights effective immediately, Jet Airways left the door open for the possibility of a rescue deal still coming through. The airline even said the cancellation of flights was only “temporary” – a mere “suspension” that might suggest a White Knight would come to the rescue.

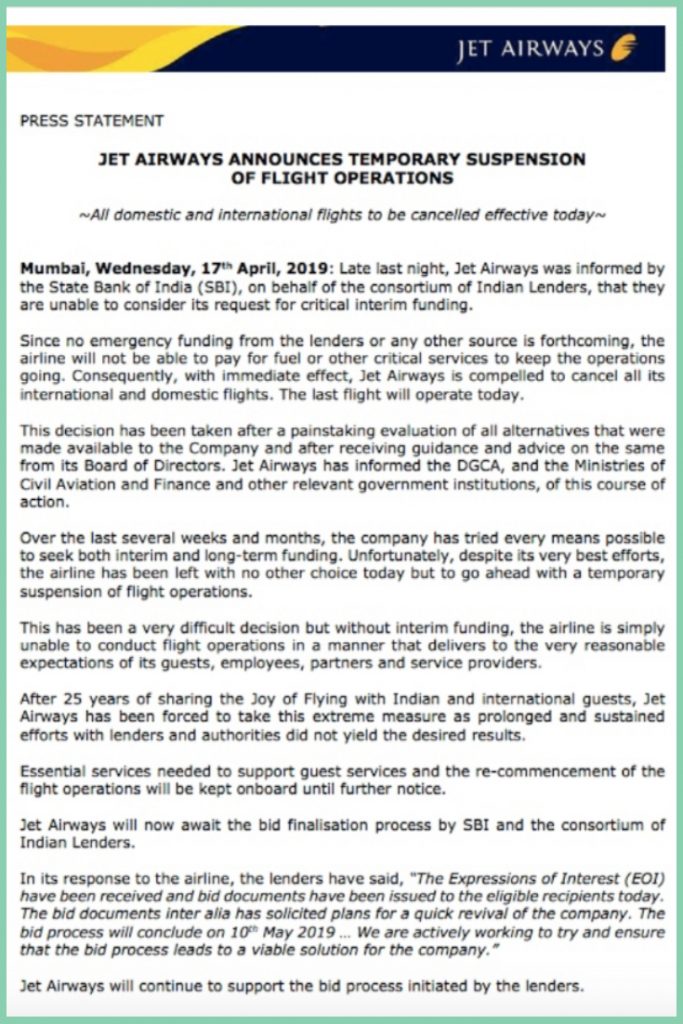

That might be wishful thinking. At just before 7pm this evening, Jet Airways sent through a notice to the Bombay Stock Exchange detailing exactly what had happened. It said the State Bank of India, which was leading a consortium of investors and lessors, had refused to offer the debt-laden airline an emergency loan that would save it from the brink of collapse.

The airline said that despite a “painstaking evaluation” of alternatives (of which there were none), the Board was compelled to cancel all international and domestic flights (not that there were many remaining anyway) because it couldn’t afford fuel or other critical services.

The airline had stopped paying for everything else a long time ago – pilots, cabin crew and many other staffers have gone without pay for months. Invoices have been ignored and multi-billionaire dollar loans for aircraft had been defaulted upon. Lessors had already forced Jet Airways to ground most of its fleet and were in the process of repossessing them.

Around a week ago, Jet Airways even had a Boeing 777 seized at Amsterdam Schipol airport (AMS). By this point, the airline was said to be operating just 32 aircraft from a fleet that had once numbered 119 – some estimates suggest even more planes had been seized, while in the days preceding its collapse Jet had been operating a mere shadow of its former schedule.

Jet Airways may well have said it had suspended its international route network today but it had actually pulled the plug on those flights last week – again claiming the suspension was merely temporary.

The airline has been drowning in over $1 billion of debt and had been loss-making for years. In a recent statement, the airline blamed “extraordinary headwinds and challenges” that had affected the entire aviation industry.

Minority investor Etihad Airways, which acquired a 24% stake in Jet Airways back in 2013, had apparently agreed to increase its stake to 49% as part of an attempt to inject some extra liquidity into the airline’s coffers. But sources said Etihad would only agree to pump cash into the ailing Indian carrier if its founder and majority shareholder Naresh Goyal stood down.

Goyal, who founded Jet Airways 25 years ago, agreed to reduce his stake to just 25.5% at the end of March but by this point, Etihad had distanced itself from getting involved in any potential rescue deal.

Somehow, Jet Airways remains hopeful.

“Tomorrow is another day and tomorrow provides us with new hope, new opportunity and new expectations. We know that India is better off with a flying Jet Airways, and so do our potential investors,” the airline said in a statement.

There still seems to be hope that the State Bank of India and other investors will somehow pull through. And while Etihad appears to have washed its hands of Jet Airways, the Abu Dhabi-based airline that has its own financial difficulties to worry about tells us its continuing to “work with Jet management, lenders and key stakeholders in the context of the lender-managed effort to restructure the company.”

The Etihad spokesperson continued: “Following the announcement that Jet Airways has suspended operations, Etihad continues to re-accommodate and support affected guests. Our teams are assisting guests with their travel arrangements and rebooking those affected onto the next available flights.”

For now, the fate of 16,000 employees hangs in the balance. Jet Airways may never experience the Joy of Flying ever again.

India is one of the biggest and fastest growing markets in global commercial aviation but airlines have consistently struggled to turn a profit. Analysts put some of the problems down to India’s regulatory and tax framework, as well as stiff competition between carriers that have pushed down ticket prices to unsustainable levels

Related

Mateusz Maszczynski honed his skills as an international flight attendant at the most prominent airline in the Middle East and has been flying ever since... most recently for a well known European airline. Matt is passionate about the aviation industry and has become an expert in passenger experience and human-centric stories. Always keeping an ear close to the ground, Matt's industry insights, analysis and news coverage is frequently relied upon by some of the biggest names in journalism.